Record Existing Home Prices in 91 Percent of Metros Q3 2020

As people have spent more time at home during this pandemic, for many where they live has had the greatest impact on the quality of their life. This has resulted in the greatest intrinsic value of housing for this generation which translates to record home prices. As the demand for homes rose -- enhanced by the affordability made possible by record-low interest rates -- prices rocketed.

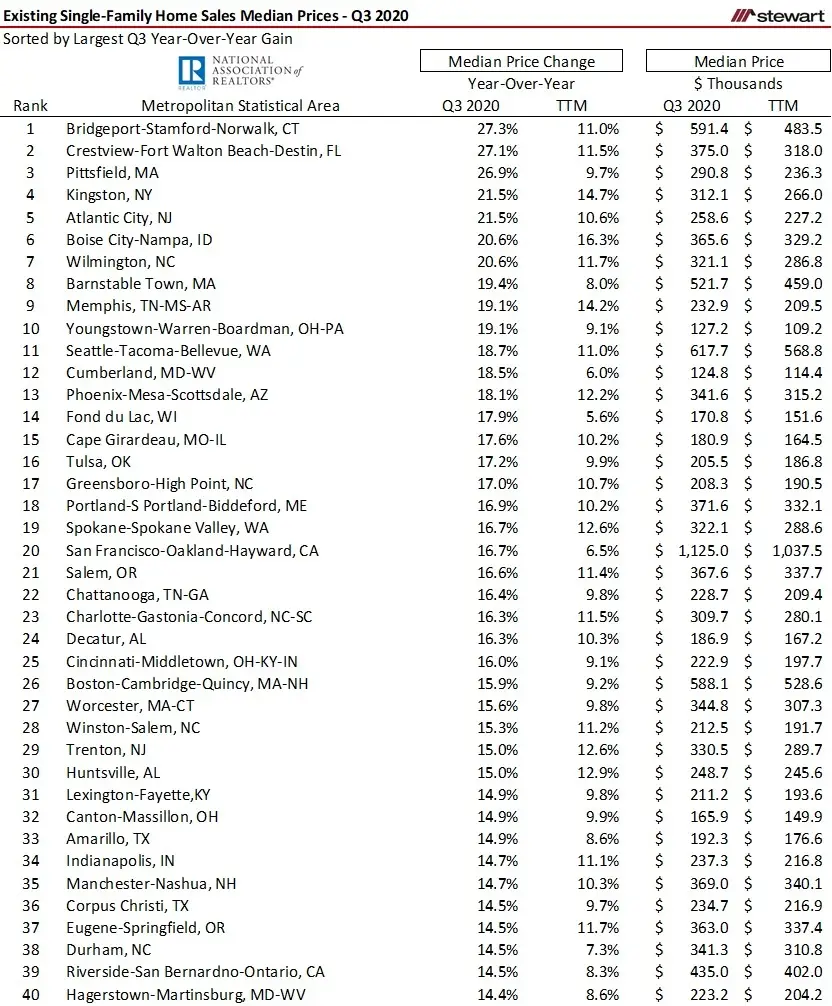

More than nine-out-of-10 metro areas (91.2 percent) posted record median prices for single family dwellings in Q3 2020 as reported by the National Association of Realtors® (NAR). NAR reports Metropolitan Statistical Area (MSA) median existing single-family home prices each quarter, with data for 181 MSAs included in the latest Q3 2020 report.

The first table shows the 40 MSAs posting the greatest Q3 2020 year-over-year gain in median price of existing homes. Though ranked by year-over-year change in Q3 median price, also included is the corresponding median price for the trailing-twelve-months (TTM), which was calculated by averaging the four quarterly medians.

The 40 metros with the smallest price gain are shown in the next table. Not one single MSA included in the NAR report posted a year-over-year quarterly decline in median price, with Decatur, Illinois the lowest in the country, still up 1.9 percent from Q3 2019 to Q3 2020. In comparison, the top gaining MSA in the country, Bridgeport-Stamford- Norwalk, Connecticut, was 14.4 times that of Decatur.

The next table shows the top median home price gains on a TTM basis, comparing the period from Q4 2019 to Q3 2020 to the prior 12 months. Leading the pack was Boise, Idaho which posted an incredible 16.3 percent increase.

While each and every metro posted a year-over-year quarterly median price gain, the same was not true on a TTM basis. Just three of the 181 metros (1.7 percent), however, did not see a home price rise: Binghamton, NY down 3.2 percent, Shreveport-Bossier City, LA -1.8 percent and Bloomington-Normal, IL down a miniscule 0.1 percent.

The 40 MSAs with the highest and lowest median home prices in Q3 2020 are shown in the next two tables.

Click here for the PDF with median prices and related metrics for all 181 MSAs included in the NAR quarterly report, sorted alphabetically by metro.

To access the plethora of NAR housing statistics click https://www.nar.realtor/research-and-statistics

There is no axiom that house prices will always go up. Housing price escalation may not only wane but could decline as interest rates rise and the pandemic subsides in the coming year as the population becomes vaccinated and herd immunity develops. As the fears of the pandemic reside, time spent at home will decay along with the intrinsic value of the home.

Ted